The smart Trick of Hard Money Atlanta That Nobody is Discussing

Wiki Article

Little Known Questions About Hard Money Atlanta.

Table of ContentsEverything about Hard Money AtlantaHard Money Atlanta Can Be Fun For EveryoneHow Hard Money Atlanta can Save You Time, Stress, and Money.The smart Trick of Hard Money Atlanta That Nobody is DiscussingHard Money Atlanta for Beginners

These jobs are generally finished rapidly, thus the requirement for fast accessibility to funds. Benefit from the task can be utilized as a down payment on the next, therefore, difficult cash car loans allow capitalists to range as well as turn more residential or commercial properties per time - hard money atlanta. Considered that the fixing to resale amount of time is brief (commonly much less than a year), house flippers do not require the lasting financings that typical mortgage loan providers supply.Traditional loan providers may be thought about the antithesis of tough cash lending institutions. What is a tough money lending institution?

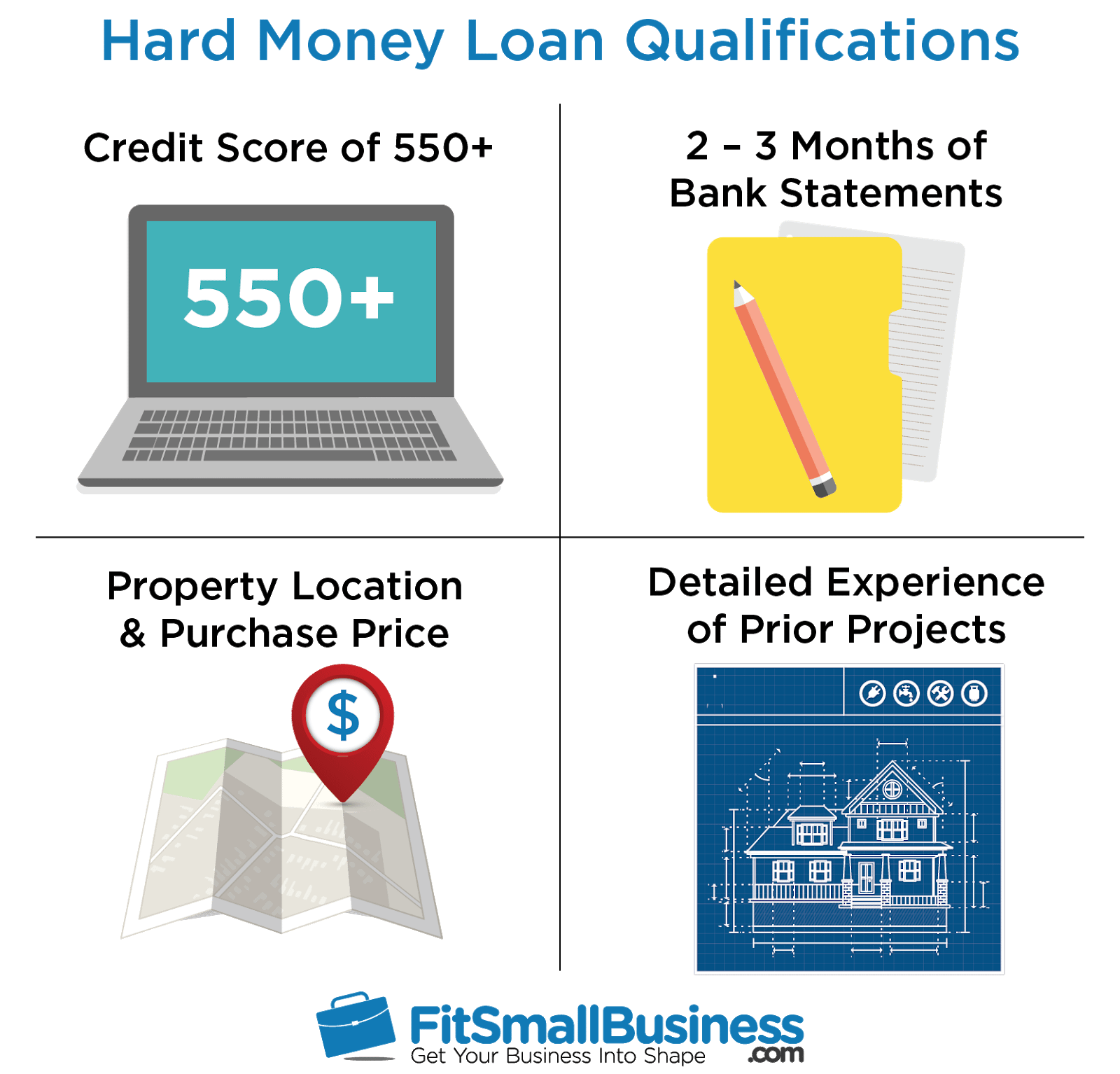

Usually, these factors are not one of the most important consideration for financing qualification (hard money atlanta). Instead, the worth of the home or asset to be purchased, which would also be made use of as security, is mainly taken into consideration. Passion prices may also vary based on the lending institution and the sell question. Most lending institutions may bill rate of interest varying from 9% to also 12% or even more.

Hard cash lending institutions would additionally bill a fee for providing the loan, and these charges are additionally understood as "points." They normally wind up being anywhere from 1- 5% of the total car loan sum, nonetheless, points would typically amount to one percentage factor of the car loan. The major difference in between a hard cash lender and also various other loan providers depends on the approval procedure.

The smart Trick of Hard Money Atlanta That Nobody is Discussing

A hard money lender, on the other hand, concentrates on the property to be purchased as the top consideration. Credit history scores, earnings, as well as various other private needs come additional. They also vary in terms of convenience of access to funding as well as rate of interest prices; difficult cash loan providers provide funding swiftly and also bill higher rate of interest prices.You might find one in one of the following means: A simple web search Request recommendations from local genuine estate agents Request recommendations from real estate investors/ capitalist teams Given that the car loans are non-conforming, you ought to take your time evaluating the demands and terms offered before making a determined and informed choice.

It is important to run the numbers before going with a tough cash financing to make certain that you do not face any kind of loss. Use for your hard cash finance today as well as get a funding commitment in 24 hr.

A tough money finance is a collateral-backed funding, safeguarded by the genuine estate being acquired. The size of the finance is determined by the estimated value of the residential property after recommended repairs over here are made.

Hard Money Atlanta Can Be Fun For Everyone

The majority of tough cash car loans have a term of six to twelve months, although in some instances, longer terms can be organized. The borrower makes a monthly settlement to the lending institution, commonly an interest-only payment. Here's how a regular hard cash finance functions: The consumer wishes to buy a fixer-upper for $100,000.

Some lenders will certainly require more cash in the offer, and ask for a minimum down payment of 10-20%. It can be advantageous for the investor to look for the lending institutions that need minimal deposit options to decrease their cash money to close. There will additionally be the normal title charges connected with shutting a purchase.

See to it to contact the tough cash loan provider to see if there are early repayment charges charged or a minimal return they require. Thinking you are in the lending for 3 months, and also the residential property markets for the projected $180,000, the financier makes a profit of $25,000. If the building costs more than $180,000, the customer makes even more money.

Due to the fact that of the shorter term as well as high rate of interest, there usually needs to be improvement and upside equity to capture, whether its a flip or rental building. First, a difficult cash lending is suitable for a buyer who wants to take care of and flip an underestimated property within a fairly short period of time.

Unknown Facts About Hard Money Atlanta

It is necessary to know exactly how hard money financings work as well as exactly how they vary from conventional loans. Banks and also other conventional banks come from most lasting loans as well as home loans. These standard lenders do seldom deal in hard money car loans. Rather, tough money car loans are released by exclusive capitalists, funds or brokers that ultimately source the deals from the personal financiers or funds.

A Biased View of Hard Money Atlanta

When applying for a tough money car loan, borrowers require to show that they have adequate funding to efficiently survive a deal. Having previous property experience is likewise an and also. When thinking about just how much money to provide, many difficult money lenders think about the After Repaired Worth (ARV) of the building that is, the estimated value of the building besides improvements have been made.Report this wiki page